Risk Exposure Summary

The will analyze your entered cashflow information and compare your net cashflow against your current hedges. If your hedging is short in some periods, the analysis will indicate the amount needed to cover the shortage and actionable recommendations to cover it.

On this page, you can view your

At the top of the page, the exchange rate![]() The rate at which one currency will be exchanged for another currency. against the base currency

The rate at which one currency will be exchanged for another currency. against the base currency![]() Usually refers to the domestic or home currency. In a currency pair, this is the first currency quoted. is displayed for all the selected currencies.

Usually refers to the domestic or home currency. In a currency pair, this is the first currency quoted. is displayed for all the selected currencies.

Default View

By default, the toggle is turned OFF and the page displays a view. In this view, the table displays a concise summary, and does not display the rows for the selected foreign currencies. The details of the table are hidden, and you will see a message prompting you to toggle to view your hedges summary details. Toggle the Detail View to ON (toggle to the right) to view all the selected currencies for the cashflow.

.png)

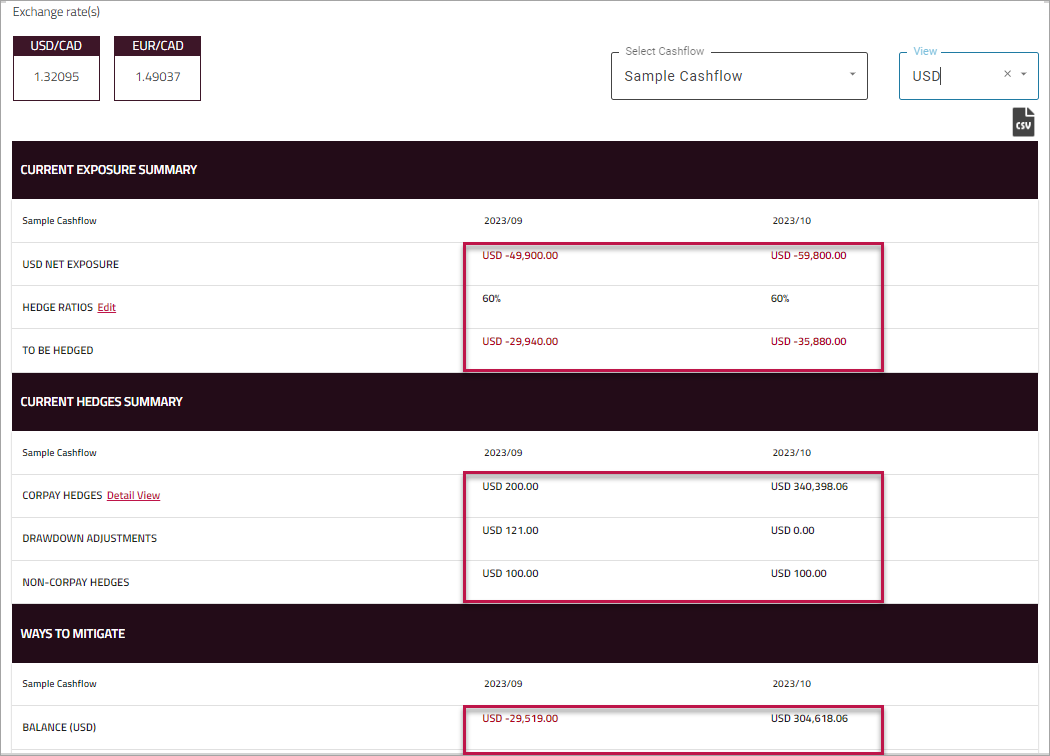

View Exposure Summary by Currency

If you have selected multiple currencies for the cashflow and prefer to view the for one currency at a time, you can select that currency from the drop-down. The page will update and display the for the selected currency.

Note: The toggle is not displayed in the individual currency view.

Select Cashflow

The dropdown will display a list of all your completed cashflows, with the most recently modified cashflow appearing at the top of the list. You can switch between your current cashflow and your saved cashflows for data comparison.

- By default, the dropdown will display the name of the current cashflow. You have the option to scroll and choose a cashflow from the list or you can filter the list by typing the name of the cashflow.

- After you've chosen a cashflow, it will load as the per the view currently set on the page, allowing you to make edits and regenerate recommendations as needed.

Note:- The dropdown list will only include saved and completed cashflows.

- If you've chosen a currency from the dropdown and then switched the cashflow from the dropdown list, the selected cashflow will load as the Default View on the page.

Print/Export Risk Exposure Summary

Click one of the icons at the top of the page to print the summary as PDF or export the results to a CSV file.

Note:The option to print to PDF is only available for Cumulative view. By default, the system will print the PDF report in portrait mode. However, to maintain optimal formatting, it is recommended to print the PDF report in landscape mode.

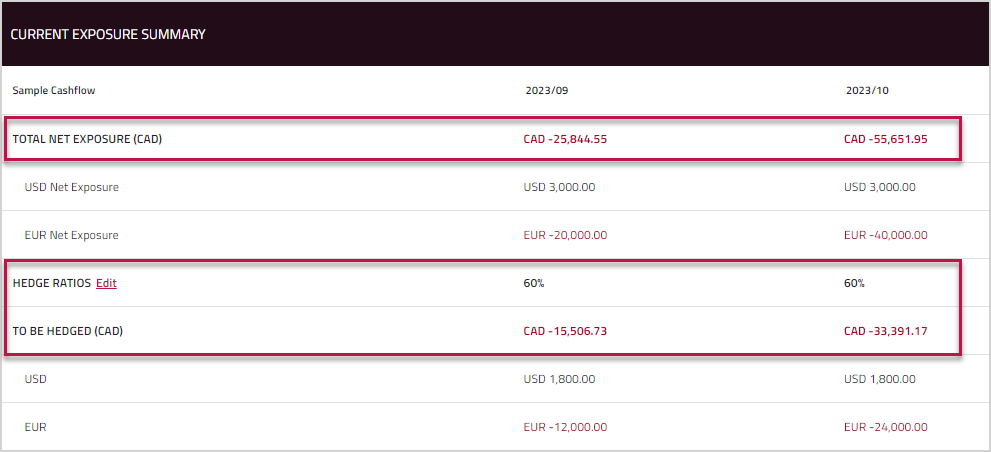

Current Exposure Summary

In this table, you can view the current net exposure for your cashflow to help you determine your hedging requirement for the current cashflow horizon.

Note: Toggle to view all the selected currencies for the cashflow.

-

The first row will display your cashflow name and the current horizon specified for the cashflow.

-

The row will show the total net amount converted to the base currency using the exchange rate displayed at the top of the page. The base currency code is prefaced to the amount here. Below this row, the net cashflow for each currency selected (prefaced with their currency code) is shown. The values in this table will match the values shown in the table for Net Cashflow on the Review Summary page. Negative values displayed in Red indicate your risk exposure.

-

The row will display the hedge percentage you entered in the table for Hedge Ratios on the Review Summary page. You can modify the hedge ratios to view how the percentage impacts the hedging recommendations. Click to modify the percentage. In the dialog, enter your preferred for the selected horizon. The entered value is saved when you click and the page will refresh with updated recommendations for you to review.

Note:

-

You can enter a value between 0-100 (both inclusive). You cannot exceed 100.

-

You cannot enter a decimal or an invalid number. If you attempt to add a decimal number the system will round it to the nearest integer.

-

To close the dialog without saving any changes, click or click outside the dialog.

-

The row displays the hedging amount which is calculated by multiplying the by the percentage. The subsequent rows show the hedging amounts for each selected currency (prefaced with their currency codes), calculated similarly. Negative values displayed in Red indicate that your outgoing expenses exceed your incoming funds. The and the section will help you identify your strategy to cover your risk exposure.

Note: The system will round off the calculated hedge amount to the nearest 2 decimal places.

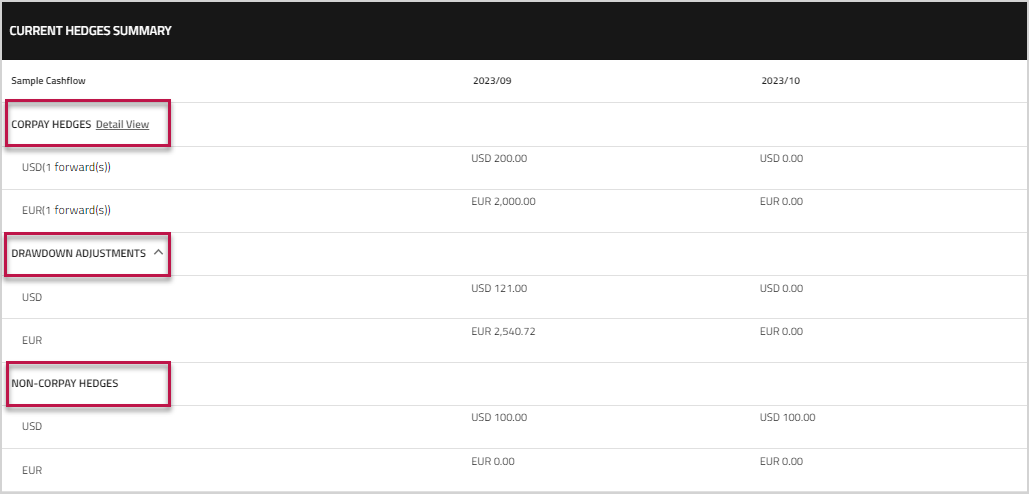

Current Hedges Summary

In this table, you can view a summary of the hedges you currently have with Corpay (including drawdowns) and the hedges that you have booked outside of Corpay.

: Toggle to view your Current Hedges Summary.

-

The first row will display your cashflow name and the current horizon specified for the cashflow.

-

The row shows the hedges placed for each currency selected (prefaced with their currency code). The system will retrieve the list of your booked forwards expiring in the selected horizon and display the total number of forwards available against the selected currency. Click the link to view a list of your available forwards that you have booked with Corpay. For more information, see Corpay Hedges.

-

If you or your dealer have executed any drawdowns against the forward contract

A risk management tool that allows you to mitigate the risk of fluctuating exchange rates by locking in a foreign currency rate today, for the settlement at a future date, or series of dates. to cover your shortfalls, as outlined in the section, the drawdown amounts that have been booked against the forward contract for each currency (prefaced with their respective currency code) will be displayed in the row. The values displayed here will help you assess the impact of the drawdown on your balance calculation in the section and analyze its effect on your cashflow.

A risk management tool that allows you to mitigate the risk of fluctuating exchange rates by locking in a foreign currency rate today, for the settlement at a future date, or series of dates. to cover your shortfalls, as outlined in the section, the drawdown amounts that have been booked against the forward contract for each currency (prefaced with their respective currency code) will be displayed in the row. The values displayed here will help you assess the impact of the drawdown on your balance calculation in the section and analyze its effect on your cashflow.

Note: This row will be collapsed if there are no drawdowns booked in the selected horizon. -

The row shows the hedges placed outside of Corpay for each currency selected (prefaced with their currency code). The values in this table are populated from the values you entered in the Non-Corpay Hedges table on the Enter Cashflow Transactions page.

Ways to Mitigate

The system will analyze and calculate the difference between your cash flow hedging needs and your existing hedges. This will help you identify if you have any shortfalls and assess if you need additional hedges to cover them. If there is a shortfall, the algorithm will recommend possible strategies to cover the shortfalls in your hedges and secure your cashflow exposure against FX risk.

-

The first row will display your cashflow name and the current horizon specified for the cashflow.

-

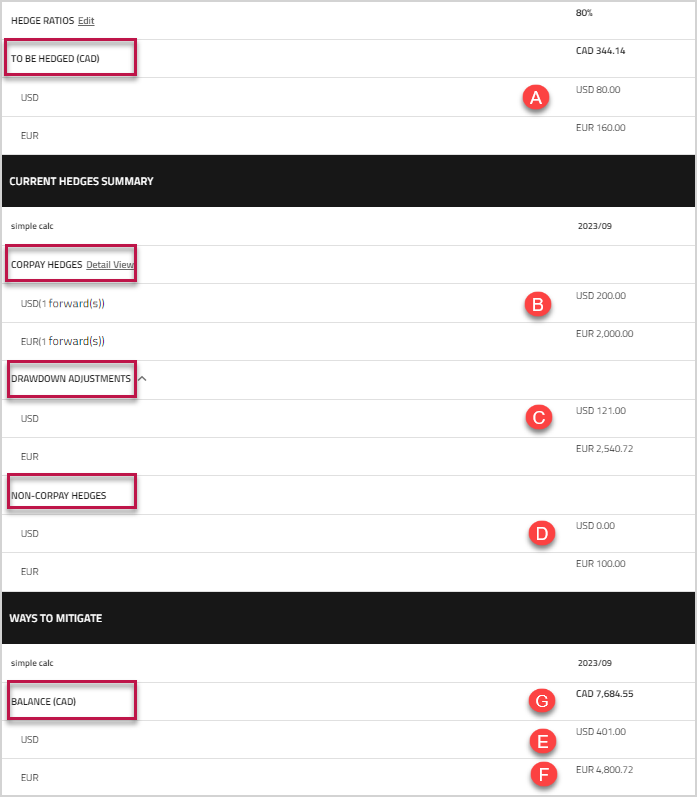

The row will show the sum of all the foreign currency balances converted to base currency using the exchange rate displayed at the top of the page. Below this row, the balance for each currency selected (prefaced with their currency code) is shown. The amount displayed for each currency is calculated as the sum of + + . Negative balances displayed in Red indicate that your current hedges (Corpay and Non-Corpay) are insufficient to cover the portion of the net cashflow you wish to hedge.

Note: If there is a drawdown executed against a forward, the is calculated as the sum of + + + .EXAMPLE

In this example, CAD is the base currency Usually refers to the domestic or home currency. In a currency pair, this is the first currency quoted. and the selected currencies for the cashflow are USD and EUR. The conversion rates for this example are USD/CAD = 1.32095 and EUR/CAD = 1.49037.

Usually refers to the domestic or home currency. In a currency pair, this is the first currency quoted. and the selected currencies for the cashflow are USD and EUR. The conversion rates for this example are USD/CAD = 1.32095 and EUR/CAD = 1.49037.

= + + = [E] USD 401.00*1.32095 = CAD 529.70095. Similarly, the balance for EUR is calculated [F] EUR= 4800.72 *1.49037= CAD 7154.8490664.

The BALANCE (CAD) row will show the sum of the converted balances CAD 529.70095 + CAD 7154.8490665 = CAD 7684.5500164 rounded off to [G] CAD 7684.55.

Risk Mitigation Strategies

uses advanced algorithms to analyze and recommend proactive measures to mitigate and protect your cashflow from potential FX risks. From the recommended risk mitigation strategies,you can book a Forward Trade directly through our platform Corpay Cross-Border. However, for executing options like Drawing down against a Forward or Rollover, please contact your account representative.

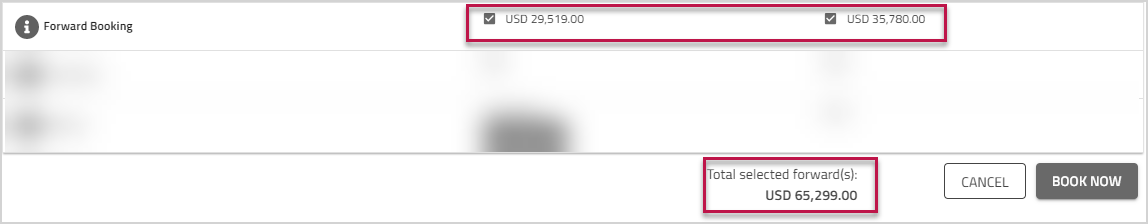

You can directly book Multi-Forwards from this section to cover your hedging needs in horizons where you are underhedged. You can hover your mouse over the ![]() information icon to view an explanation of the data displayed in this row. will recommend the forward booking amount for each currency based on the calculated shortfall. To book a forward:

information icon to view an explanation of the data displayed in this row. will recommend the forward booking amount for each currency based on the calculated shortfall. To book a forward:

-

Select the checkbox next to the amount to book the forwards. At the bottom of the table, a list is displayed for the , which will display the total selected forwards grouped by their currencies.

Note: The checkbox for the forward is disabled if the maturity date is less than 3 days from the forward open date. -

To remove a forward from the list, uncheck the forward. Click to remove all selected forwards from the list.

-

Click to book the forwards. You'll be redirected to the Multi Forwards page with the selected forwards added to the table. For more information, see Booking a Multi Forwards order.

Note: If the amount of the forward exceeds your allowed per trade transaction limit, a message appears to let you know that the amount is over your Per-trade Entry Limit. You will not be able to add that forward to the order. Please contact your account representative for further assistance.On the page,

-

If the cashflow is set to , the maturity date for the forward is scheduled for the last business day of the month. When the frequency is set to , the maturity date for the forward is scheduled for the Friday of that week. If the maturity date falls on a weekend or a holiday, the system will automatically adjust the maturity date to the nearest available business day.

-

The system will select the forward's currency as buy and your base currency for settlement.

-

The is set to .

-

Drawdowns![]() To exercise a contract before its value date is refered to as the Drawdown of a Forward or an Options contract. allow you to draw funds from a forward contract before its Maturity Date. You can draw down funds from a period where you are over-hedged and use those funds to cover a shortfall in an earlier period. will recommend the drawdown amount and specify the month or start of the week (dependent on the selected frequency) to which the amount should be extended. To draw down against a forward, please contact your account representative for further assistance.

To exercise a contract before its value date is refered to as the Drawdown of a Forward or an Options contract. allow you to draw funds from a forward contract before its Maturity Date. You can draw down funds from a period where you are over-hedged and use those funds to cover a shortfall in an earlier period. will recommend the drawdown amount and specify the month or start of the week (dependent on the selected frequency) to which the amount should be extended. To draw down against a forward, please contact your account representative for further assistance.

-

When you book a drawdown against a forward contract, the drawdown amount for that currency and period will be updated in the row under the section in the table.

Note: You can hover your mouse over the ![]() information icon to view an explanation of the data displayed in this row.

information icon to view an explanation of the data displayed in this row.

Rollover![]() To move or extend a Forward or Options contract by a certain duration. is used to extend a forward contract to a date in the future. This allows you to reallocate a forward from a period where you are over-hedged and use that forward to cover a shortfall in a later period. The will recommend the rollover amount and specify the month or start of the week to which the amount should be extended. To roll over a forward contract, please contact your account representative for further assistance.

To move or extend a Forward or Options contract by a certain duration. is used to extend a forward contract to a date in the future. This allows you to reallocate a forward from a period where you are over-hedged and use that forward to cover a shortfall in a later period. The will recommend the rollover amount and specify the month or start of the week to which the amount should be extended. To roll over a forward contract, please contact your account representative for further assistance.

Note: You can hover your mouse over the ![]() information icon to view an explanation of the data displayed in this row.

information icon to view an explanation of the data displayed in this row.

Note: Client represents and warrants that they are only inputting data they have the right to process. Client acknowledges that they are solely responsible for the quality, reliability, and accuracy of all data they enter, as well as any reports generated from that data.